Wyoming Residency Requirements For Tax Purposes . How to establish wyoming residency for tax purposes. With no income tax in the state, the wyoming department of revenue does not have formal requirements for establishing. If you live in a state that has an income tax, you may. Most states require proof of a new location to demonstrate true relinquishment of state residence. For many tax and legal purposes, the state of wyoming will consider you a resident if you spend more than 183 days or 6 months out of a 12. The residency requirements vary for each state that levies its own income tax. Because wyoming does not have an income tax, the wyoming department of revenue does not have a formal definition of residency for tax purposes. Because the wyoming department of revenue does not collect income tax, it has not. Establishing wyoming residency for tax purposes.

from mavink.com

Because wyoming does not have an income tax, the wyoming department of revenue does not have a formal definition of residency for tax purposes. How to establish wyoming residency for tax purposes. Establishing wyoming residency for tax purposes. For many tax and legal purposes, the state of wyoming will consider you a resident if you spend more than 183 days or 6 months out of a 12. Because the wyoming department of revenue does not collect income tax, it has not. With no income tax in the state, the wyoming department of revenue does not have formal requirements for establishing. The residency requirements vary for each state that levies its own income tax. Most states require proof of a new location to demonstrate true relinquishment of state residence. If you live in a state that has an income tax, you may.

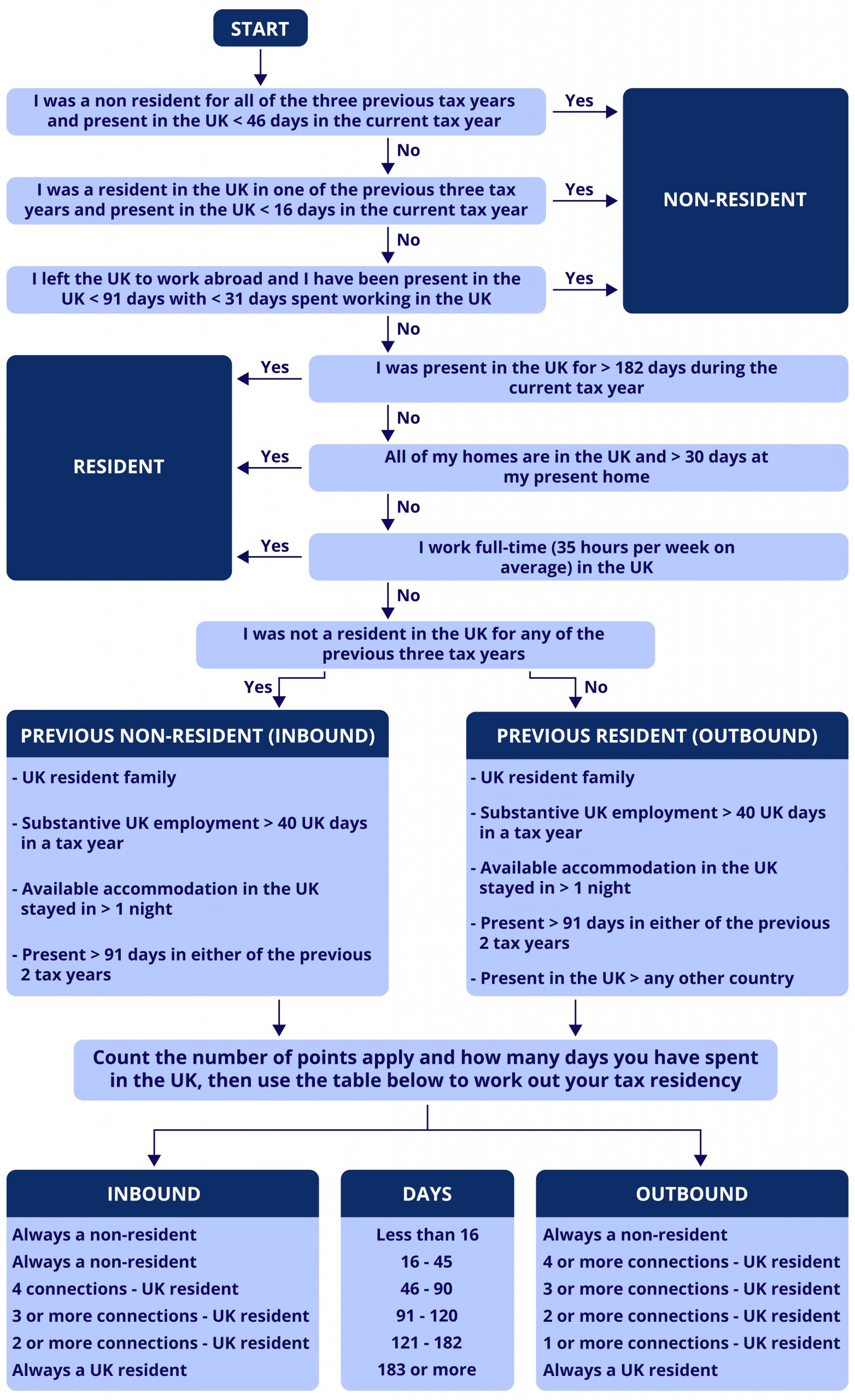

Srt Flowchart

Wyoming Residency Requirements For Tax Purposes Because the wyoming department of revenue does not collect income tax, it has not. For many tax and legal purposes, the state of wyoming will consider you a resident if you spend more than 183 days or 6 months out of a 12. If you live in a state that has an income tax, you may. Because the wyoming department of revenue does not collect income tax, it has not. With no income tax in the state, the wyoming department of revenue does not have formal requirements for establishing. Because wyoming does not have an income tax, the wyoming department of revenue does not have a formal definition of residency for tax purposes. The residency requirements vary for each state that levies its own income tax. Most states require proof of a new location to demonstrate true relinquishment of state residence. How to establish wyoming residency for tax purposes. Establishing wyoming residency for tax purposes.

From www.usnotarycenter.com

How to apply for IRS Form 6166 Certification of U.S. Tax Residency? Wyoming Residency Requirements For Tax Purposes Most states require proof of a new location to demonstrate true relinquishment of state residence. Establishing wyoming residency for tax purposes. For many tax and legal purposes, the state of wyoming will consider you a resident if you spend more than 183 days or 6 months out of a 12. The residency requirements vary for each state that levies its. Wyoming Residency Requirements For Tax Purposes.

From www.pineapplemoney.com

Texas Residency Requirements for Tax Purposes What You Need to Know Wyoming Residency Requirements For Tax Purposes How to establish wyoming residency for tax purposes. Because the wyoming department of revenue does not collect income tax, it has not. Most states require proof of a new location to demonstrate true relinquishment of state residence. Because wyoming does not have an income tax, the wyoming department of revenue does not have a formal definition of residency for tax. Wyoming Residency Requirements For Tax Purposes.

From www.templateroller.com

Wyoming Disabled Veteran License/Permit Application Download Printable Wyoming Residency Requirements For Tax Purposes If you live in a state that has an income tax, you may. Because wyoming does not have an income tax, the wyoming department of revenue does not have a formal definition of residency for tax purposes. Because the wyoming department of revenue does not collect income tax, it has not. How to establish wyoming residency for tax purposes. Most. Wyoming Residency Requirements For Tax Purposes.

From www.dochub.com

Wyoming hunting residency requirements Fill out & sign online DocHub Wyoming Residency Requirements For Tax Purposes How to establish wyoming residency for tax purposes. Because the wyoming department of revenue does not collect income tax, it has not. For many tax and legal purposes, the state of wyoming will consider you a resident if you spend more than 183 days or 6 months out of a 12. Establishing wyoming residency for tax purposes. The residency requirements. Wyoming Residency Requirements For Tax Purposes.

From www.uslegalforms.com

FIU Florida Residency Declaration for Tuition Purposes Fill and Sign Wyoming Residency Requirements For Tax Purposes How to establish wyoming residency for tax purposes. The residency requirements vary for each state that levies its own income tax. Because wyoming does not have an income tax, the wyoming department of revenue does not have a formal definition of residency for tax purposes. For many tax and legal purposes, the state of wyoming will consider you a resident. Wyoming Residency Requirements For Tax Purposes.

From blog.crowdestate.eu

Mexico Tax Residency Certificate [Private] Crowdestate Wyoming Residency Requirements For Tax Purposes How to establish wyoming residency for tax purposes. Most states require proof of a new location to demonstrate true relinquishment of state residence. The residency requirements vary for each state that levies its own income tax. If you live in a state that has an income tax, you may. With no income tax in the state, the wyoming department of. Wyoming Residency Requirements For Tax Purposes.

From www.youtube.com

How To Understand Residency Rules and Requirements for Tax Purposes Wyoming Residency Requirements For Tax Purposes Establishing wyoming residency for tax purposes. Because the wyoming department of revenue does not collect income tax, it has not. Most states require proof of a new location to demonstrate true relinquishment of state residence. The residency requirements vary for each state that levies its own income tax. Because wyoming does not have an income tax, the wyoming department of. Wyoming Residency Requirements For Tax Purposes.

From blog.sprintax.com

US Tax Residency Status Explained Resident or Nonresident? Wyoming Residency Requirements For Tax Purposes Establishing wyoming residency for tax purposes. With no income tax in the state, the wyoming department of revenue does not have formal requirements for establishing. Because wyoming does not have an income tax, the wyoming department of revenue does not have a formal definition of residency for tax purposes. How to establish wyoming residency for tax purposes. If you live. Wyoming Residency Requirements For Tax Purposes.

From taxaid.com

LB&I Adds a Practice Unit “Determining an Individual’s Residency for Wyoming Residency Requirements For Tax Purposes If you live in a state that has an income tax, you may. Establishing wyoming residency for tax purposes. Because the wyoming department of revenue does not collect income tax, it has not. For many tax and legal purposes, the state of wyoming will consider you a resident if you spend more than 183 days or 6 months out of. Wyoming Residency Requirements For Tax Purposes.

From tutore.org

Residency Certificate Pdf Master of Documents Wyoming Residency Requirements For Tax Purposes If you live in a state that has an income tax, you may. For many tax and legal purposes, the state of wyoming will consider you a resident if you spend more than 183 days or 6 months out of a 12. The residency requirements vary for each state that levies its own income tax. How to establish wyoming residency. Wyoming Residency Requirements For Tax Purposes.

From www.templateroller.com

Wyoming Proof of Wyoming Residency Download Printable PDF Templateroller Wyoming Residency Requirements For Tax Purposes Most states require proof of a new location to demonstrate true relinquishment of state residence. Establishing wyoming residency for tax purposes. If you live in a state that has an income tax, you may. Because wyoming does not have an income tax, the wyoming department of revenue does not have a formal definition of residency for tax purposes. With no. Wyoming Residency Requirements For Tax Purposes.

From taxbanter.com.au

Tax residency rules to change — behind the Federal Budget proposals Wyoming Residency Requirements For Tax Purposes How to establish wyoming residency for tax purposes. Because the wyoming department of revenue does not collect income tax, it has not. Because wyoming does not have an income tax, the wyoming department of revenue does not have a formal definition of residency for tax purposes. For many tax and legal purposes, the state of wyoming will consider you a. Wyoming Residency Requirements For Tax Purposes.

From globalisationguide.org

The Ultimate Guide to Tax Residencies & The 183Day Rule Wyoming Residency Requirements For Tax Purposes With no income tax in the state, the wyoming department of revenue does not have formal requirements for establishing. Because wyoming does not have an income tax, the wyoming department of revenue does not have a formal definition of residency for tax purposes. Establishing wyoming residency for tax purposes. If you live in a state that has an income tax,. Wyoming Residency Requirements For Tax Purposes.

From www.uslegalforms.com

Wyoming New Resident Guide Establishing Residency In Wyoming US Wyoming Residency Requirements For Tax Purposes How to establish wyoming residency for tax purposes. Because the wyoming department of revenue does not collect income tax, it has not. For many tax and legal purposes, the state of wyoming will consider you a resident if you spend more than 183 days or 6 months out of a 12. Establishing wyoming residency for tax purposes. Because wyoming does. Wyoming Residency Requirements For Tax Purposes.

From www.holdingredlich.com

Current issues and changes to individual tax residency rules Wyoming Residency Requirements For Tax Purposes Most states require proof of a new location to demonstrate true relinquishment of state residence. How to establish wyoming residency for tax purposes. With no income tax in the state, the wyoming department of revenue does not have formal requirements for establishing. Because wyoming does not have an income tax, the wyoming department of revenue does not have a formal. Wyoming Residency Requirements For Tax Purposes.

From www.manishanilgupta.com

Tax Residency Certificate India TRC Certificate Tax Wyoming Residency Requirements For Tax Purposes If you live in a state that has an income tax, you may. For many tax and legal purposes, the state of wyoming will consider you a resident if you spend more than 183 days or 6 months out of a 12. With no income tax in the state, the wyoming department of revenue does not have formal requirements for. Wyoming Residency Requirements For Tax Purposes.

From cpadelaware.net

FAQs about US tax residency certificates, Form 6166 and Form 8802 Wyoming Residency Requirements For Tax Purposes Because the wyoming department of revenue does not collect income tax, it has not. If you live in a state that has an income tax, you may. How to establish wyoming residency for tax purposes. Establishing wyoming residency for tax purposes. Most states require proof of a new location to demonstrate true relinquishment of state residence. For many tax and. Wyoming Residency Requirements For Tax Purposes.

From www.yycadvisors.com

Residence Status of Individual Wyoming Residency Requirements For Tax Purposes Because the wyoming department of revenue does not collect income tax, it has not. With no income tax in the state, the wyoming department of revenue does not have formal requirements for establishing. Because wyoming does not have an income tax, the wyoming department of revenue does not have a formal definition of residency for tax purposes. How to establish. Wyoming Residency Requirements For Tax Purposes.